CASE RESULTS

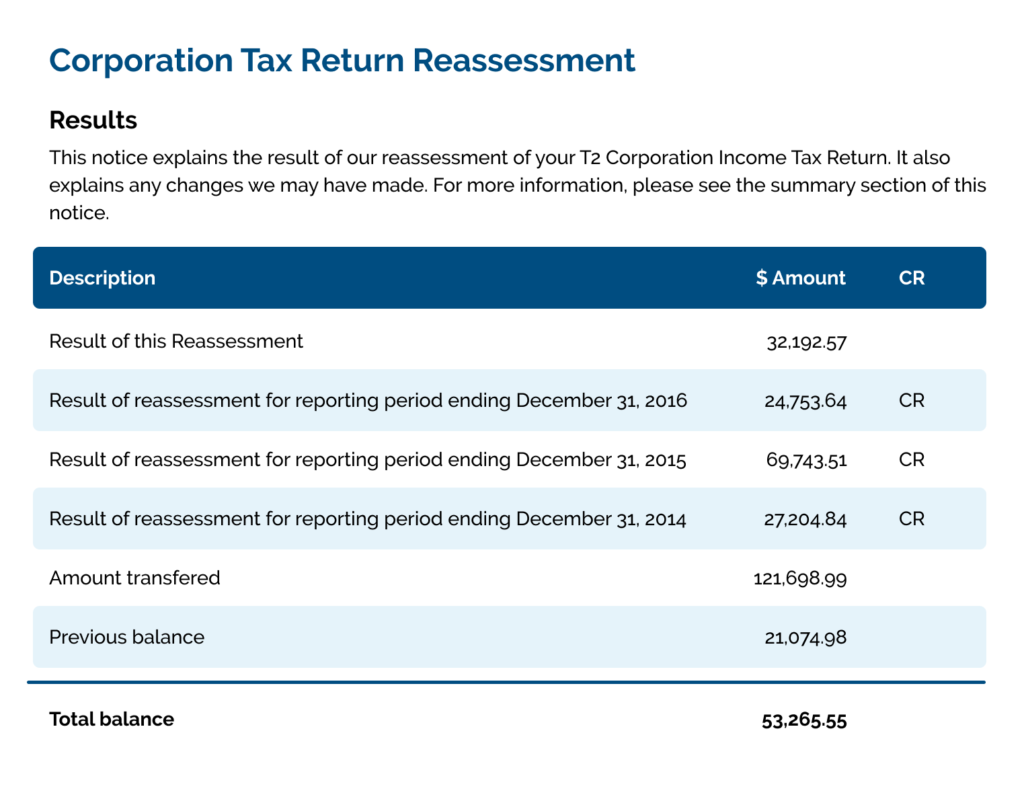

Case I: Corporation Tax Return Reassessment

|

Businessman Credited by CRA After Successful Corporation Tax Return Reassessment Case issue: A client approached us who was dealing with multiple CRA-related problems with his various companies. Approach: We reviewed one of his company’s books and tax filing and discovered that the previous accountant had made significant mistakes. We decided to reconstruct his books and records and appeal the CRA audit decision. Result: As a result of our work, the CRA appeal officer accepted our submission as is and credited his corporate income tax account with $121,000. |

|

Case II: Net Worth Audit

|

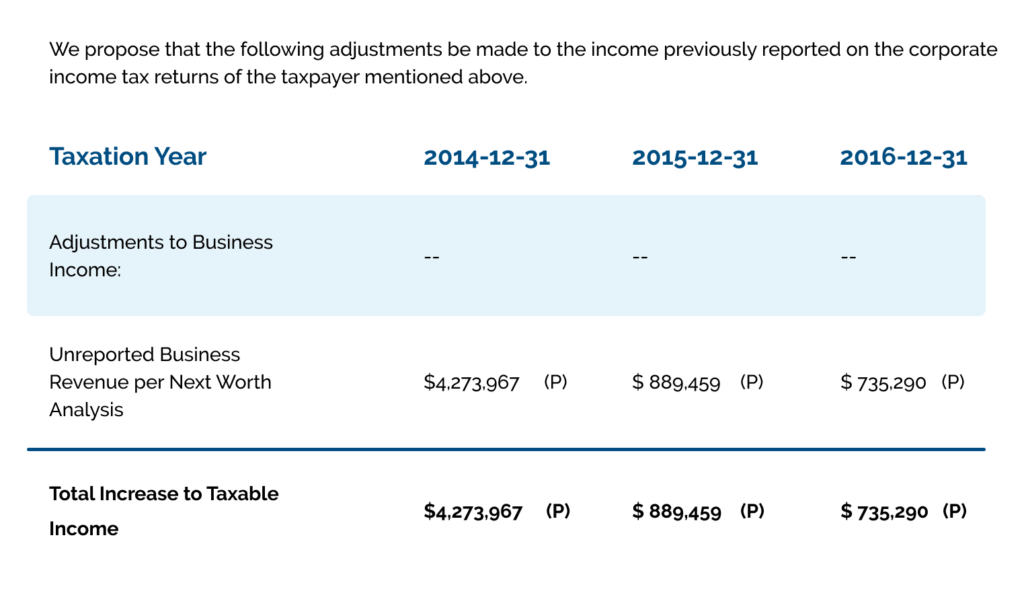

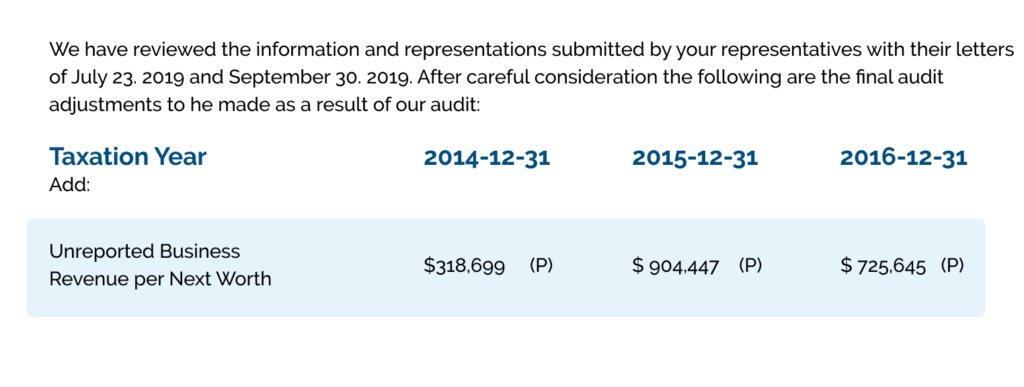

Client Granted Major Reduction on Unreported Income After Net Worth Audit Case issue: A client approached our firm after CRA audit findings showed a significant amount of unreported income based on Net Worth Audit. The result of the auditor’s assessment meant that there was a considerable amount owed to the CRA. Approach: Sam has a sophisticated approach and process for fighting unique cases with complex audits. He found several mistakes made by the auditor. When Sam challenged the auditor’s decision because of the mistakes, the errors were rectified. Result: As a result, our firm was able to reduce the unreported income by approximately 4 million dollars. Our firm believes that the amount should be reduced even more after further action is taken. |

The auditor’s results

Results after Faris CPA’s submission

|

Case III: Offshore Assets Tax Filings via Voluntary Disclosures Program

|

Client’s Unreported Assets Tax Filings via Voluntary Disclosures Program Reduces Penalties and Avoids Prosecution Case issue: A client approached us with unreported offshore assets and cash valued at approximately 10 million dollars. The client was terrified, as besides the significant interest and penalties which would apply, it was highly likely that the client would be prosecuted and sentenced to jail. Approach: Faris CPA had worked on the case tirelessly and was able to submit all amended returns under the tax amnesty, Voluntary Disclosure Program, offered by the CRA. Result: The packages were approved by CRA as is without any single question. As a result, the client saved a significant amount on interest and penalties. Most importantly, the CRA did not proceed with prosecution. |

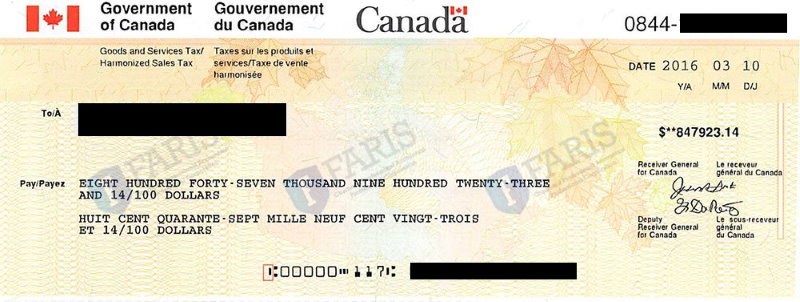

Case IV: HST Refund

|

Disallowed HST Refund Granted After Notice of Objection Case issue: A new client was referred to our firm by another client of ours. He had a problematic CRA audit that disallowed an HST refund valued at almost one million dollars. The CRA audit revealed that his previous accountant had made significant errors, resulting in the disallowing of the HST refund valued at approximately 1 million dollars. Approach: We performed an intensive review of the proposal letter from the CRA along with the income tax act. We were convinced that the case would be won if the records were corrected and a new argument was submitted as a replacement to the proposal letter from the CRA. The CRA auditor denied the response, so our firm filed a Notice of Objection to the CRA. Result: The Notice of Objection was successful. Our client was able to recover not only the original refund, but also additional amounts that the previous accountant had missed were awarded to our client as well. |

|